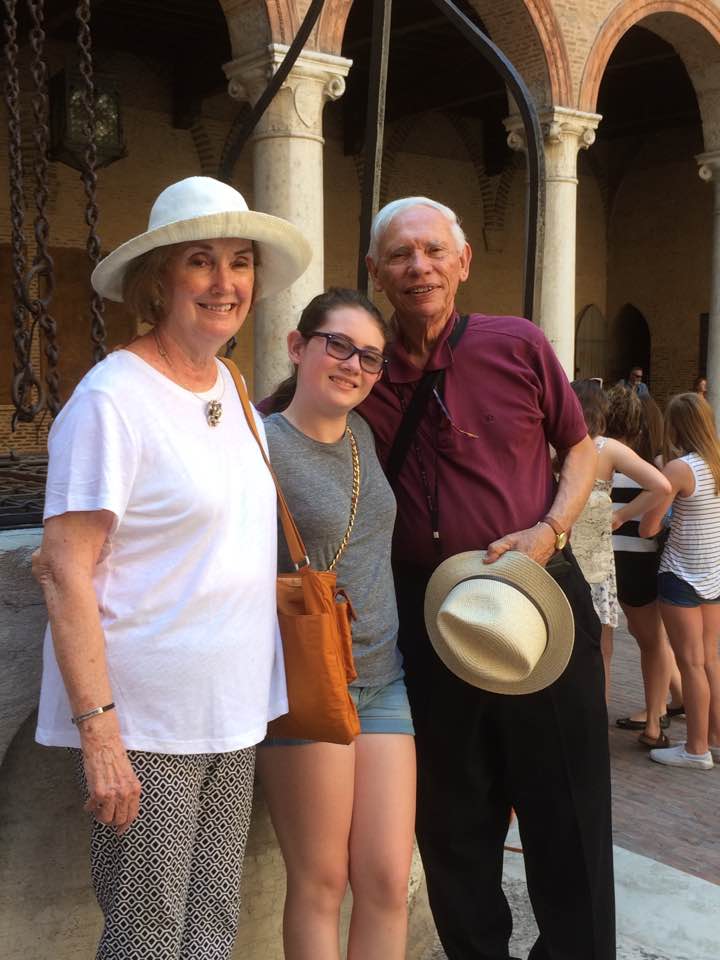

Little Rock, Ark. (Nov. 11, 2020) – Jessica Szenher of Little Rock, Ark., is the latest recipient of the Lugean L. Chilcote Award, given by Arkansas Community Foundation Board of Directors to honor exceptional service to the organization. Szenher is the 23rd recipient of the award, which was established in 1985 with Lugean L. Chilcote as the first recipient.

“This prestigious award honors those who have given exemplary service to the Foundation,” said Heather Larkin, president and CEO of the Community Foundation. “Jessica has been a dear friend, advocate and an enthusiastic champion of our Foundation’s mission for over 20 years.”

A native of Little Rock, Szenher is retiring in November after more than 40 years as a public relations and communications professional. She is past president and a long-time member of the Arkansas Chapter of Public Relations Society of America. The society awarded her the Crystal Award in 2000 for her significant and continuous contributions to the field of public relations.

After earning her bachelor’s degree in journalism and home economics from the University of Arkansas – Fayetteville, Szenher began her career as a reporter for the Texarkana Gazette. She moved back to Little Rock to work in corporate communications for Southwestern Bell Telephone Company. Szenher also worked in healthcare communications and for Little Rock marketing firm Stone Ward before founding her consulting business, Jessica Szenher Consulting.

An active member of First United Methodist Church, Szenher served on the Altar Guild, led the Confirmation and Member Care teams, was active in adult education and the food ministry, and served on various other church committees.

She and her husband Doug have two grown children, James and John Michael.

###

Arkansas Community Foundation, a nonprofit organization with over a half billion dollars in assets, fosters smart giving to improve communities. The Community Foundation offers tools to help Arkansans protect, grow and direct their charitable dollars as they learn more about community needs. By making grants and sharing knowledge, the Foundation supports existing charitable programs that work for Arkansas and partners to create initiatives that address unmet needs. Since 1976, the Community Foundation has provided more than $314 million in grants and partnered with thousands of Arkansans to help them improve our neighborhoods, our towns and our entire state. Contributions to Arkansas Community Foundation, its funds and any of its 29 affiliates are fully tax deductible.