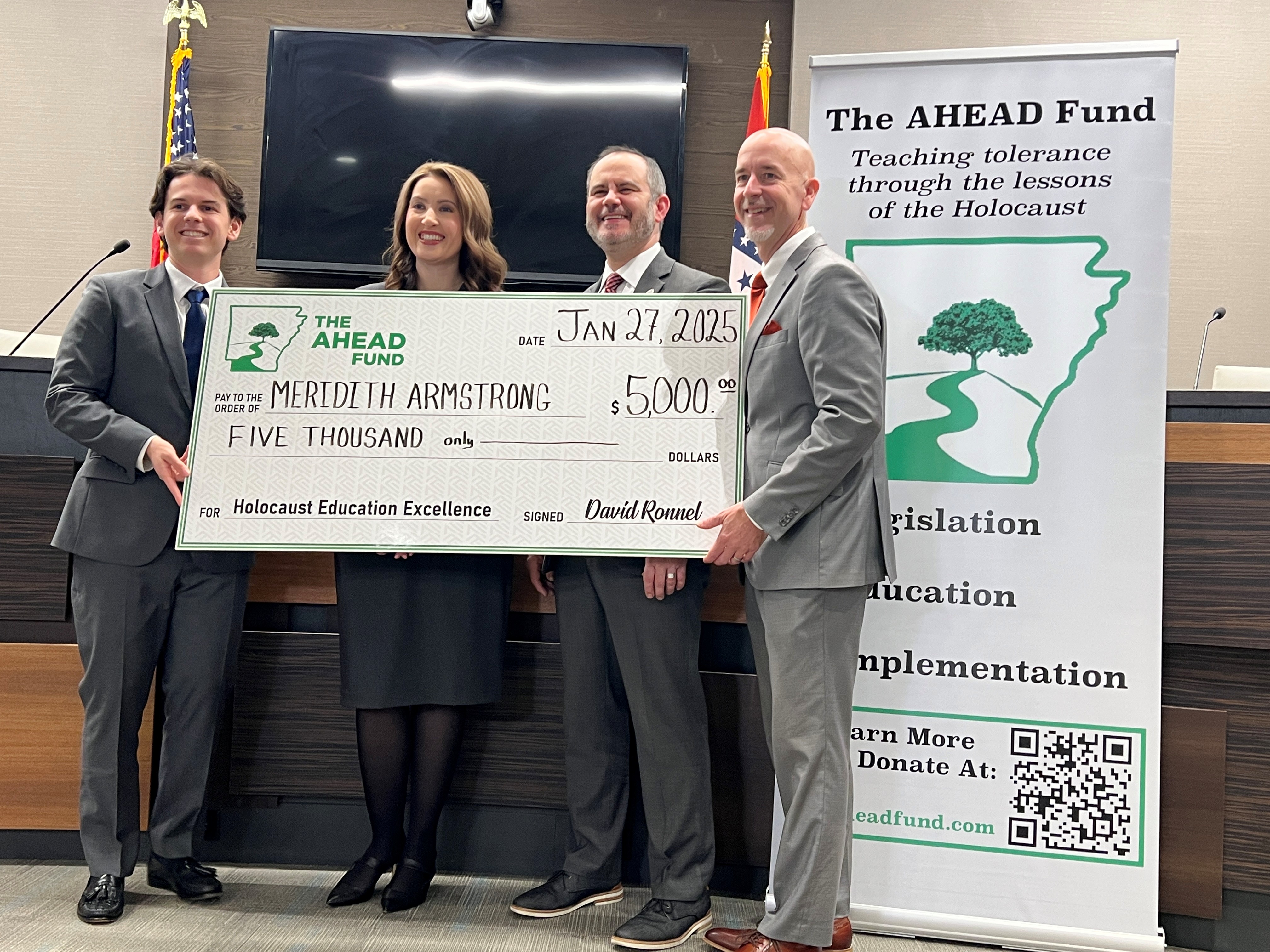

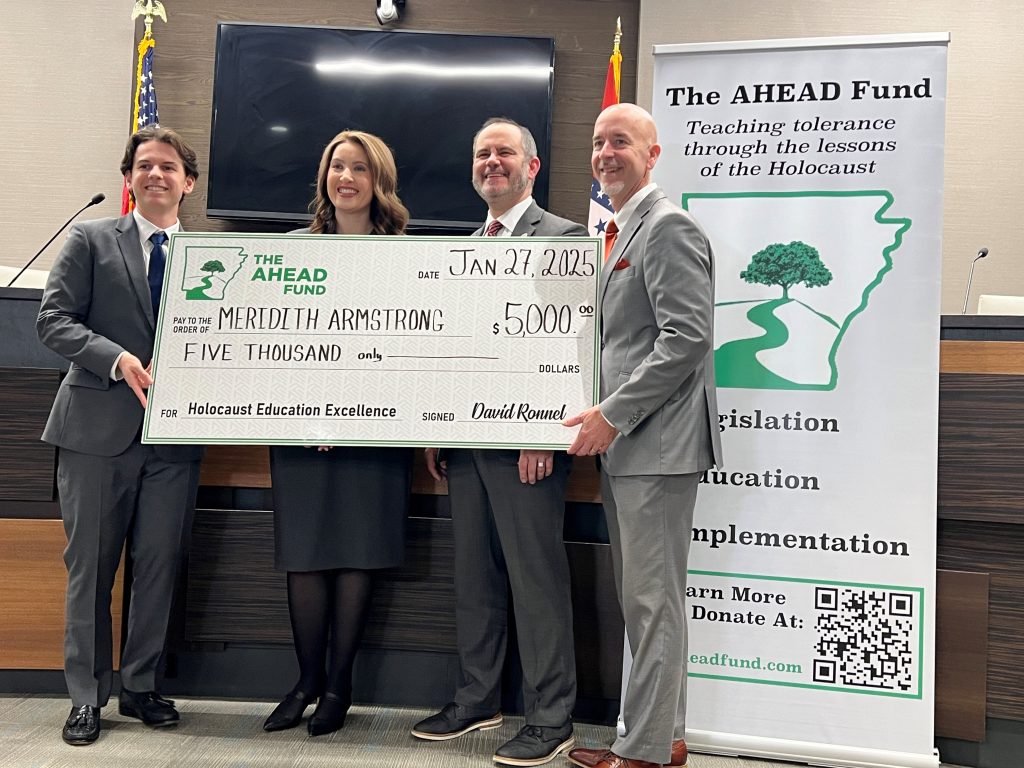

Meridith Armstrong, an 8th grade history teacher at Goza Middle School in Arkadelphia, was awarded $5,000 from The AHEAD Fund on January 27 at the Arkansas Department of Education building in Little Rock.

January 27 marks International Holocaust Remembrance Day, commemorating the victims of the Holocaust. In 2021, thanks to the efforts of former Governor Asa Hutchinson, Arkansas passed a state law requiring Holocaust education be taught in all public schools for grades 5-12. In 2023, Governor Sarah Sanders signed legislation into law that designates the last week in January as Holocaust Education Week in Arkansas.

The AHEAD Fund (Arkansas Holocaust Education Award Donation) is held at Arkansas Community Foundation. The fund recognizes Arkansas educators who go above and beyond in teaching the powerful lessons of the Holocaust.

Click here to learn more about The AHEAD Fund.

David Ronnel, Founder of The AHEAD Fund and Meridith Armstrong, 2025 Winner

“We are thrilled to celebrate one of Arkansas’s finest educators, Meridith Armstrong. Her passion for teaching the Holocaust is inspiring,” said David Ronnel, Founder of The AHEAD Fund. “Her grandfather, a World War II veteran, instilled in her the importance of Holocaust education and remembrance. In her Arkadelphia classroom, Meridith brings creativity and energy. Holocaust survivors have spoken to her students and she assigns research projects and Ted Talks on the Holocaust. She incorporates Holocaust-specific art, music and food into her lesson plans while also helping her students gain empathy, understanding and appreciation for the things that makes us different, unique and most of all, human.

“On this day, 80 years ago, Allied troops march into the concentration camp known as Auschwitz. They witnessed unimaginable scenes of horror surrounding the systemic murder of more than 11 million people,” said Ronnel. “These liberators were heroes, freeing innocent men, women and children who somehow survived these atrocities.

“Today, the AHEAD Fund serves to honor the memories of the victims, survivors and liberators of the Holocaust. At the beginning of Arkansas’ second annual Holocaust education week, we are encouraged, knowing that more schools across Arkansas are teaching students about humanity’s darkest hours, so that it is never forgotten and never repeated.”

David Ronnel, Meridith Armstrong, Jacob Oliva, Arkansas Secretary of Education and Keith Brooks, State Representative

“Holocaust education is important because it can teach students to speak up against injustice, and act as allies to those who are unjustly targeted and marginalized,” Ronnel said. “It can create a more tolerant outlook by helping students become more open to viewpoints that might be different from there own. And, with the flood of misinformation online, including a growing number of claims denying that the Holocaust ever even happened, its important now more than ever, that students learn from the horrible mistakes of the past.”