By: Adena J. White

Overconsumption of processed foods has been linked to the rising rates of diabetes, hypertension and other chronic health conditions. Access and cost are the major barriers.

To address these barriers and help improve the physical and economic health of Jefferson County, Communities Unlimited was recently awarded an “Access to Local Foods”’ grant from Arkansas Community Foundation to launch a “Food Farmacy” pilot program.

This program will provide enrolled families with access to fresh, nutritious food – as well as education and healthcare services – with the ultimate goal of improving their overall health.

Part rural development hub and part community development financial institution, or CDFI, Communities Unlimited Inc. works alongside rural community leaders and small businesses to create fair access to resources needed to sustain healthy communities, healthy businesses and healthy families.

Brenda Williams, manager of Communities Unlimited’s healthy foods initiative, wrote the grant application for the Food Farmacy project in Jefferson County, expanding upon a similar grant-funded project the organization introduced in Clarksdale, Mississippi, back in 2020. Both projects are personal to Williams, who grew up in Blytheville, Arkansas, and now lives in Mississippi.

healthy and nutritious foods, no matter

where they live.”

— Brenda Williams

“I definitely consider myself a Delta girl or a country girl at heart,” she said. “Every person has the right to access healthy and nutritious foods, no matter where they live.”

Through her role with Communities Unlimited, Williams works with small-scale, underserved growers, mostly Black farmers, to help them build farm capacity as well as connect them with market opportunities where they can sell wholesale. The Food Farmacy program will purchase locally grown produce from small-scale growers to provide fresh produce to families in Jefferson County.

Burthel Thomas, a local grower from Pine Bluff, is one of the farmers partnering with Communities Unlimited on the Food Farmacy initiative. The Dumas native did not grow up on a farm but has always aspired to farm and own land. He turned his dream into a reality and now owns 275 acres in Jefferson County near Wabbaseka and Altheimer.

Through the partnership with Communities Unlimited, Thomas and other small-scale farmers in the area can obtain additional market opportunities while supplying people in their community with healthy foods.

“The Food Farmacy project is a win-win for me and my neighbors who farm because we can partner with each other. It improves our ability to market and provides more food to people on a larger scale,” Thomas said.

Beginning this summer, the farmers will provide an assortment of fresh produce – including sweet potatoes, tomatoes and sweet corn – to select Jefferson County residents through a local healthcare clinic in Pine Bluff. The clinic has identified 20 to 25 patients with chronic health issues to participate in the Food Farmacy program.

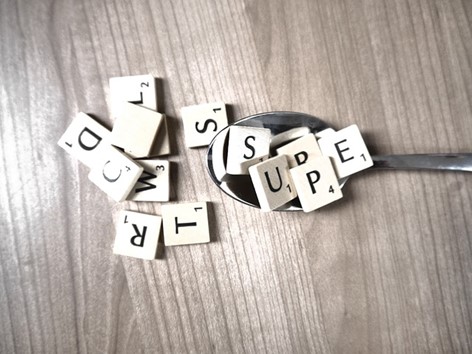

The 12-week pilot project will use the “food as medicine” model to address food insecurity and provide patients and their families with a produce voucher to be redeemed at the Food Farmacy for locally grown produce. Similar to a traditional pharmacy, the idea behind the Food Farmacy is to write patients a “prescription” to eat healthy foods to improve their health and help them better manage their underlying health conditions. It will also incorporate services that include behavior-change coaching along with cooking demonstrations by nutrition educators to support patients in the development of healthy eating habits.

“Our aim with this pilot is to help bridge the divide between food insecurity and healthcare by providing healthy foods, clinical services and nutrition education to patients,” Williams said. “We definitely want to provide nutrition education and recipes so that we’re not just giving these families produce and telling them, ‘Now go and eat well.’ The idea is to equip them with the know-how for preparing the produce that is in their boxes.”

To measure the impact of the program on health outcomes, Communities Unlimited will collect baseline labs and biometric data at the beginning of enrollment.

“Our hope is that by providing fresh, healthy foods, we will see changes in behavior that will influence the health of the participants in positive ways while supporting small-scale growers in Jefferson County,” Williams said.