The Community Foundation often gets reports back from grantees and donors. Some stories stand out and move us in a special way. Our staff were pleased to receive the following story from Emily Ironside with the Jones Center telling us about their newest launch and a special donor that helped make it happen.

This is part of Emily’s report.

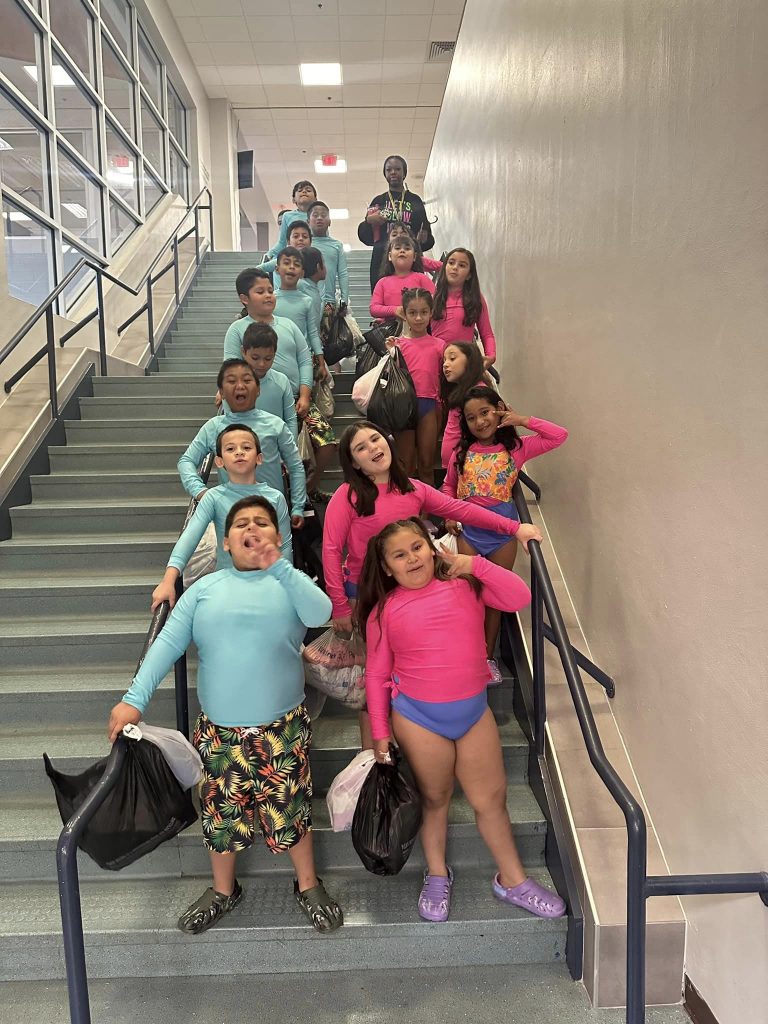

We were thrilled to launch Every Child Swims last month – a program we are piloting with Jones Elementary’s third grade class located in Springdale. The pilot program focuses on teaching students from across the school district to swim. Jane Hunt was so gracious with her time and attended the launch and initial swim test.

The initiative began with a swim proficiency test Tuesday at the Jones Center. 80% of the students did not pass the swim proficiency test and will be enrolled in free swimming lessons this semester. These classes, in addition to free teen and adult Learn to Swim classes this past year, have been made possible with Jane’s support.

One Jones Elementary student who attended came with his dad’s swimsuit–he had never owned a swimsuit his size. We knew swim gear might be a barrier to participating, so we were thrilled with Walmart Apparel’s team donated swimsuits and swim shoes for every child. The little boy with his dad’s suit beamed when he was presented with his very first swimsuit. It was a truly special moment.

At the launch last month, Jane shared her gift will be renewed again this year. That is wonderful news for the students of Springdale.

There are an estimated 4,000 fatal, unintentional drownings in the United States each year — about 11 per day, according to the Centers for Disease Control’s website. For children ages 5-14, drowning is the second leading cause of unintentional injury death after motor vehicle crashes, according to the CDC.

Almost 40 million adults — about 15% — in the U.S. don’t know how to swim and over half, 54.7%, have never taken a swimming lesson, the CDC reported in a May news release.

Arkansas currently ranks sixth in accidental drownings despite being a landlocked state.

The Jones Center leveraged Jane’s grant to secure additional funds from Step Into Swim, a national granting branch of the Pool and Hot Tub association. If successful, their vision is to expand to every elementary school in Springdale. They will work with SPS on additional funding to help grow the program, as well as seek private support through our channels.