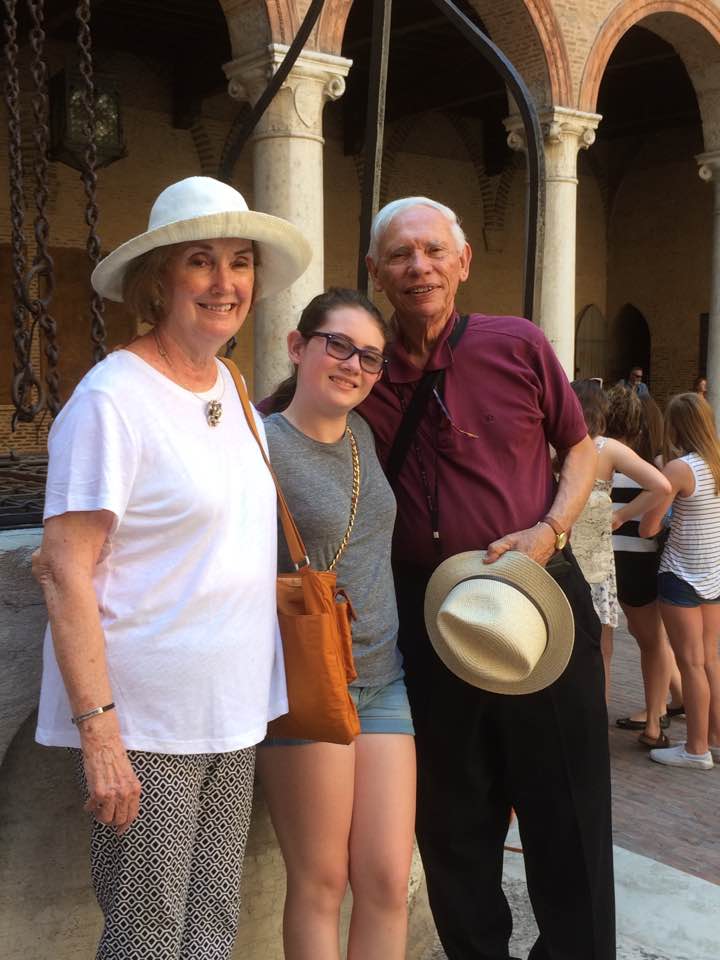

Deborah and Steve Nipper of Magnolia use their deep roots and longstanding relationships to help define and model community leadership for good causes in south Arkansas.

“Community leadership is really about people who just want to help and find a way to solve problems. They are the helpers,” Deborah said. “Steve and I both have this desire. We like being part of solutions for Magnolia. And when we got married in 1996, we agreed that what one does, the other would do too, so we are a two-for-one deal,” Deborah said.

“I was born and raised here and then went to the University of Arkansas. I came back to Magnolia to work in banking. I know lots of business owners and local community leaders,” Steve said. “But Deborah taught Kindergarten in Magnolia for 37 years, so she is like a celebrity.”

Steve and Deborah have both held seats on the Columbia County Community Foundation board, as well as dozens of other local boards in the area. Between Rotary, their church outreach, a recent COVID hotline, a local food distribution program called the Stewpot and many other causes, the Nippers are often found volunteering and showing up to help.

But alongside the various organizations and causes they support, Steve credits the Community Foundation for showing him what he calls the “miracle of endowment.”

“Magnolia is a generous community. In 2006, the Columbia County Community Foundation Affiliate opened 40 family endowments from local donors,” Steve said.

“Those funds are still providing funds to local nonprofits 15 years after they were started. An endowment is one of the most lasting ways to help causes we care about.”

One of the couple’s passions is supporting the Magnolia Arts Center — where they can sometimes even be seen on stage for local productions. “We both love the arts and love what the Magnolia Arts Center is providing this community,” Steve said. “I helped the Center acquire the building. Once it had a physical presence downtown, the growth was phenomenal. You may not expect a town with a population of 11,500 to have a robust visual and performing arts scene, but Magnolia does.”

“This town provides great opportunities for everyone here to experience the arts. We strive for inclusivity. Magnolia Arts thrives with great volunteers like the Nippers, support from the Community Foundation, local businesses and donors, members, partnerships with Southern Arkansas University, and The Magnolia School District Performing Arts Department,” said Janet Rider-Babbitt, director for Magnolia Arts and the Columbia County Community Foundation affiliate executive director.

“Steve and Deborah are a huge part of why the Arts Center is successful, but they are part of something bigger for the town of Magnolia. They epitomize community leadership by setting an example, using their influence, and showing up when help is needed.”