Starting in 2016, the Foundation began making investments in loan funds to support non-traditional borrowers at three area CDFI’s: Southern Bancorp, Communities Unlimited and FORGE Community Loan Fund. Starting during the COVID-19 pandemic, the foundation has picked up the pace of new investments to support family financial stability and business ownership for women and people of color.

For more information about impact investing, call 501-372-1116.

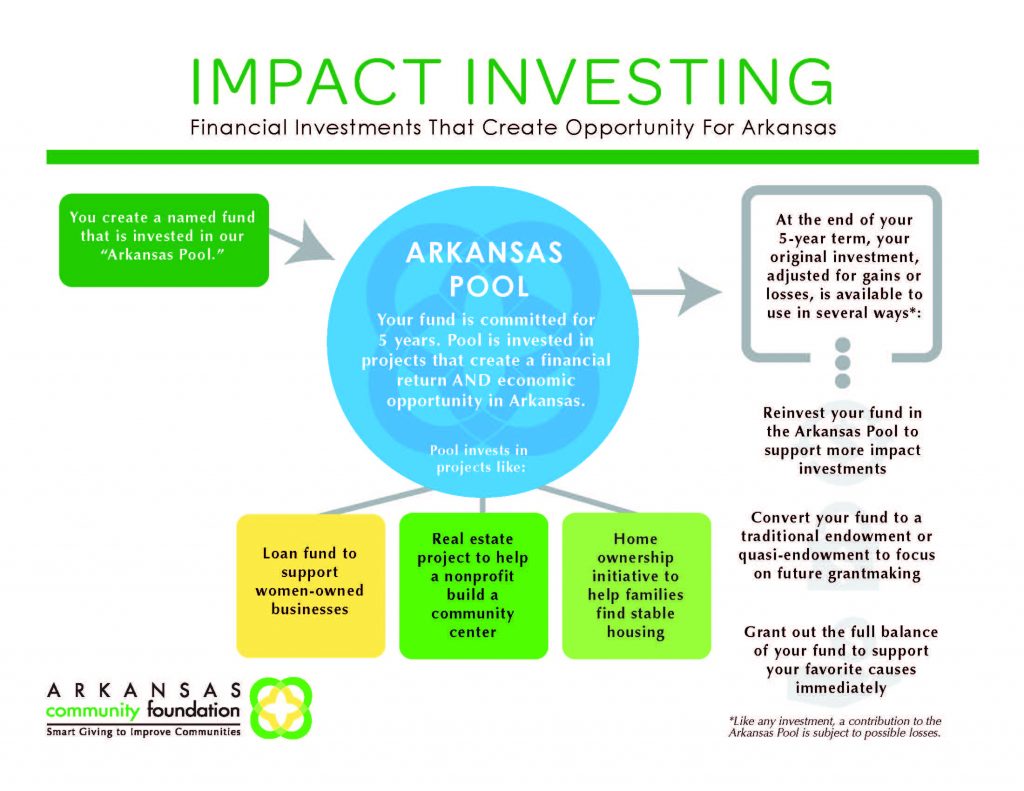

Learn how to invest in opportunity for Arkansas AND make a financial return.

Recent examples of Impact Investing at the Community Foundation:

- A 2020 loan to HOPE Credit Union enabled the CDFI to make micro-loans to Arkansas credit union members who were experiencing financial hardship due to the pandemic. The loans are intended to be credit-building only: when borrowers successfully complete loan payments, HOPE will report a positive credit event. If a borrower is unable to fully repay the loan, a loan-loss reserve fund also supported by the Foundation will cover the gap, avoiding a negative credit event for the borrower.

- A loan to PeopleTrust Community Loan Fund enabled the CDFI to accelerate the pace of lending through the Paycheck Protection Program.

- A loan to PYT Funds will help the start-up Black-owned fintech company provide last-mile college loans to students at the University of Arkansas at Pine Bluff, using a nontraditional underwriting model that does not require the student to have a credit history or co-signer. These loans are aimed at increasing the likelihood of degree completion for students who have exhausted their available federal financial aid.

- A loan to FORGE Community Loan Fund will support the Imani Fund, a lending pool that will pilot an alternative underwriting model to unlock capital for Black-owned businesses. Through the program, borrowers will receive technical assistance and entrepreneurship support, in addition to low-interest financing.